The following article is provided by the Nevada Public Employees’ Retirement System as part of its educational series for members.

Due to the low inflationary environment, the Consumer Price Index (CPI) cap is starting to affect the granting of statutory post retirement increases (PRI) for retirees. The application of the lifetime CPI cap to a benefit indicates that, over the retirement period, the retirement benefit has kept pace with inflation. The CPI is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

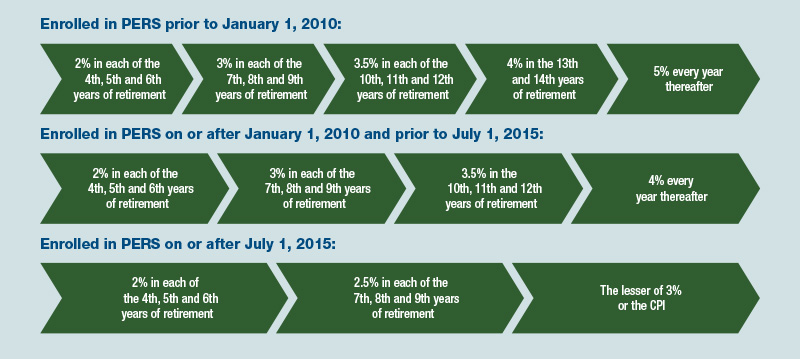

The PRI formula is set forth in NRS 286.571 through NRS 286.579. Post retirement increases begin after you have been retired for three full years and then occur annually after that. The statutory percentages are listed below in reference to enrollment date.

It is important to know that per statute, the percentage you receive can be capped by the CPI if your benefit has kept pace or increased greater than the rate of inflation on a cumulative basis during the years you are drawing it. If that occurs, you will still receive an increase; however, it will be a calculated amount based on the average of the three prior years’ CPI.

PERS will do three separate calculations in order to see if your benefit has increased in an amount equal to or greater than the rate of inflation.

Calculation 1: Compare the retiree’s benefit percentage increase since he/she began collecting.

Formula: Current benefit – beginning benefit / (beginning benefit x 100) = % of benefit increase

Example: $3,200 – $1,500 / ($1,500 x 100) = 113.33% benefit increase since inception

Current Benefit $3,200

Beginning Benefit $1,500

113.33% benefit increase since inception

Calculation 2: Compare the CPI percentage increase since the retiree began collecting.

Formula: Current CPI – beginning CPI / (beginning CPI x 100) = % change since benefit began

Example: 184.6 – 100.2 / (100.2 x 100) = 84.23%

Current CPI 184.6%

Beginning CPI 100.2%

84.4% increase in CPI since retiree’s benefit inception

Result: 113.33% benefit increase is greater than 84.4% CPI increase

The result in this case is that the benefit has increased greater than the rate of inflation during the same time period and therefore is capped by the CPI three-year average for the current fiscal year.

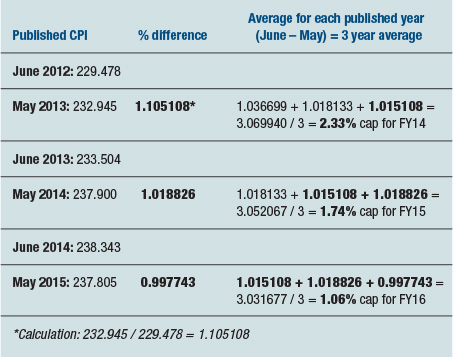

Calculation 3 (this calculation is done once per fiscal year): As required by NRS 286.571 through NRS 286.5756(b), the cap is based on the average rate of inflation as provided by the Consumer Price Index (all items) for the three preceding years. Using the published percentages, we calculate the three-year average by comparing percentages in effect for June of the first year and May of the following year. This calculation is completed for three consecutive years and the totals from each year are averaged together.

Calculation 3 (this calculation is done once per fiscal year): As required by NRS 286.571 through NRS 286.5756(b), the cap is based on the average rate of inflation as provided by the Consumer Price Index (all items) for the three preceding years. Using the published percentages, we calculate the three-year average by comparing percentages in effect for June of the first year and May of the following year. This calculation is completed for three consecutive years and the totals from each year are averaged together.

Please refer to the Nevada Public Employees’ Retirement System website, www.nvpers.org, for more information on the CPI and PRI White Paper on the homepage. If you have any questions, you can also call NVPERS at (866) 473-7768.